Investments, financial products, money: How good is financial knowledge in Germany?

Dealing with money and understanding investments, debts and financial instruments determine whether people achieve a financially stable life and reach financial goals. So far, so clear. But how comprehensive is knowledge in financial matters - and is there a difference between "perceived" and actual financial literacy in Germany?

The IU short study "Financial literacy. What is the level of financial literacy in Germany?" deals exactly with these questions and reveals the discrepancy between self-perception and reality: "People in Germany overestimate their financial literacy," comments Prof. Dr Johannes Treu, Professor of General Business Administration and Economics at IU International University of Applied Sciences, on the results of the representative survey.

View the study as PDF

Financial literacy in Germany: the facts

89.3 %

of respondents educate themselves on financial topics.

79.7 %

rate their financial literacy as very good to quite good.

10.7 Points

out of a maximum of 20 points is the average score achieved by respondents in a representative survey of their financial literacy.

Dealing with finances is a life task

„Financial literacy is a lifelong task, which is why people with more life experience feel better informed. A few years ago, the EU introduced legislation to ensure greater transparency in the financial market in order to protect investors. This covers advisory obligations, product governance and more. But many do not understand the information well enough. We need to provide young people in particular with better financial literacy, because this is precisely the age at which the greatest results can be achieved in terms of pension provision, for example."

Prof. Dr Johannes Treu

Professor of General Business Administration and Economics at IU International University of Applied Sciences

Financial literacy: How to learn, whom to trust?

More than nine out of ten respondents find financial literacy quite to very important. But how do they educate themselves, how do they act and who do they ask for advice on financial decisions?

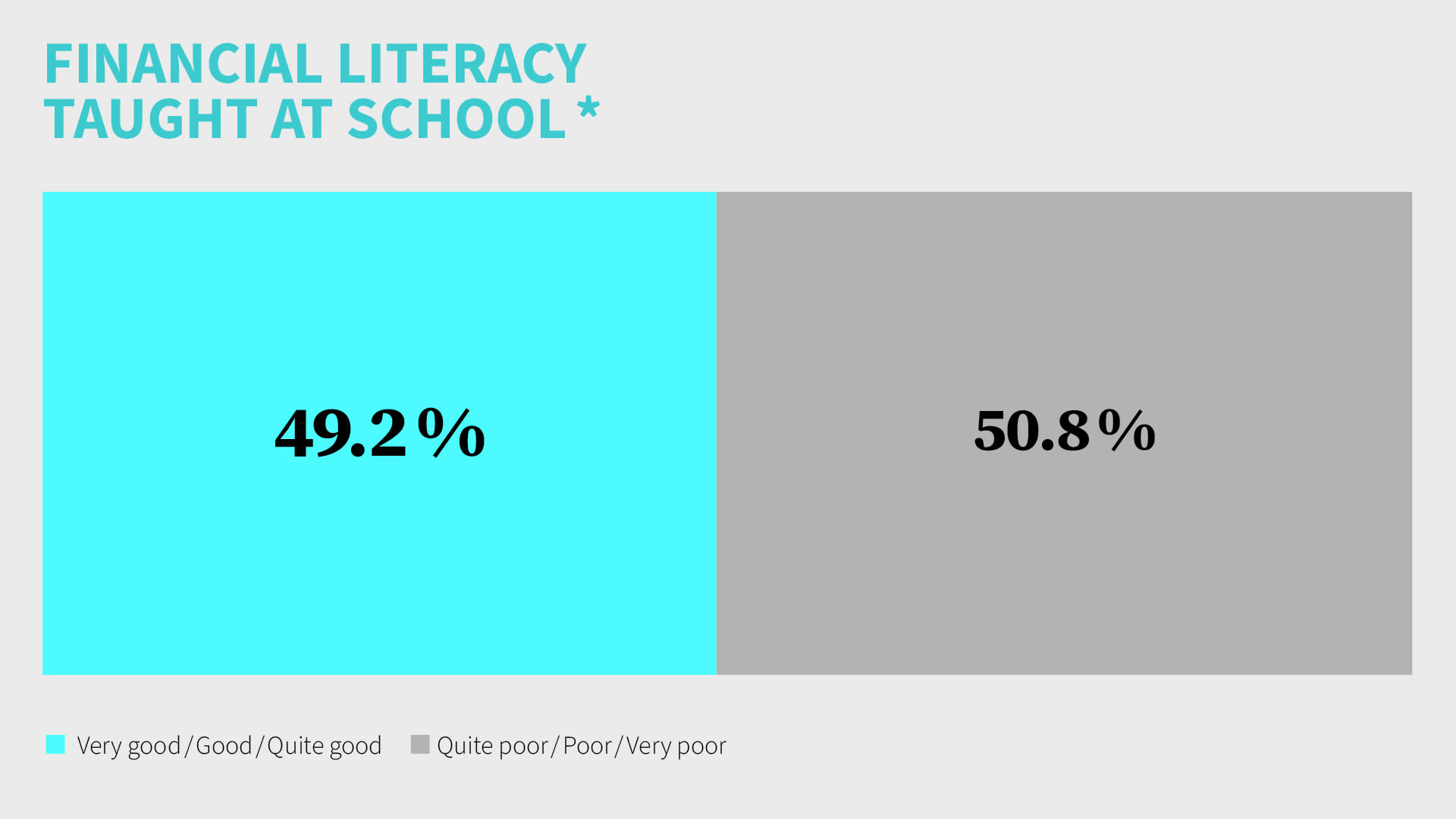

Only about half feel financially educated through school

Financial literacy for students and in schools is essential. This is what IU expert Prof. Dr Johannes Treu says in an interview (p. 5 in the IU short study). However, 50.8 per cent of people in Germany do not feel financially well educated through their school education with subjects such as economics or social studies.

*Answers to the question: "How do you rate the level of financial literacy you gained from your school education (e.g. in subjects like economics, social studies)?"

Source: IU short study "Financial literacy. What is the level of financial literacy in Germany?"

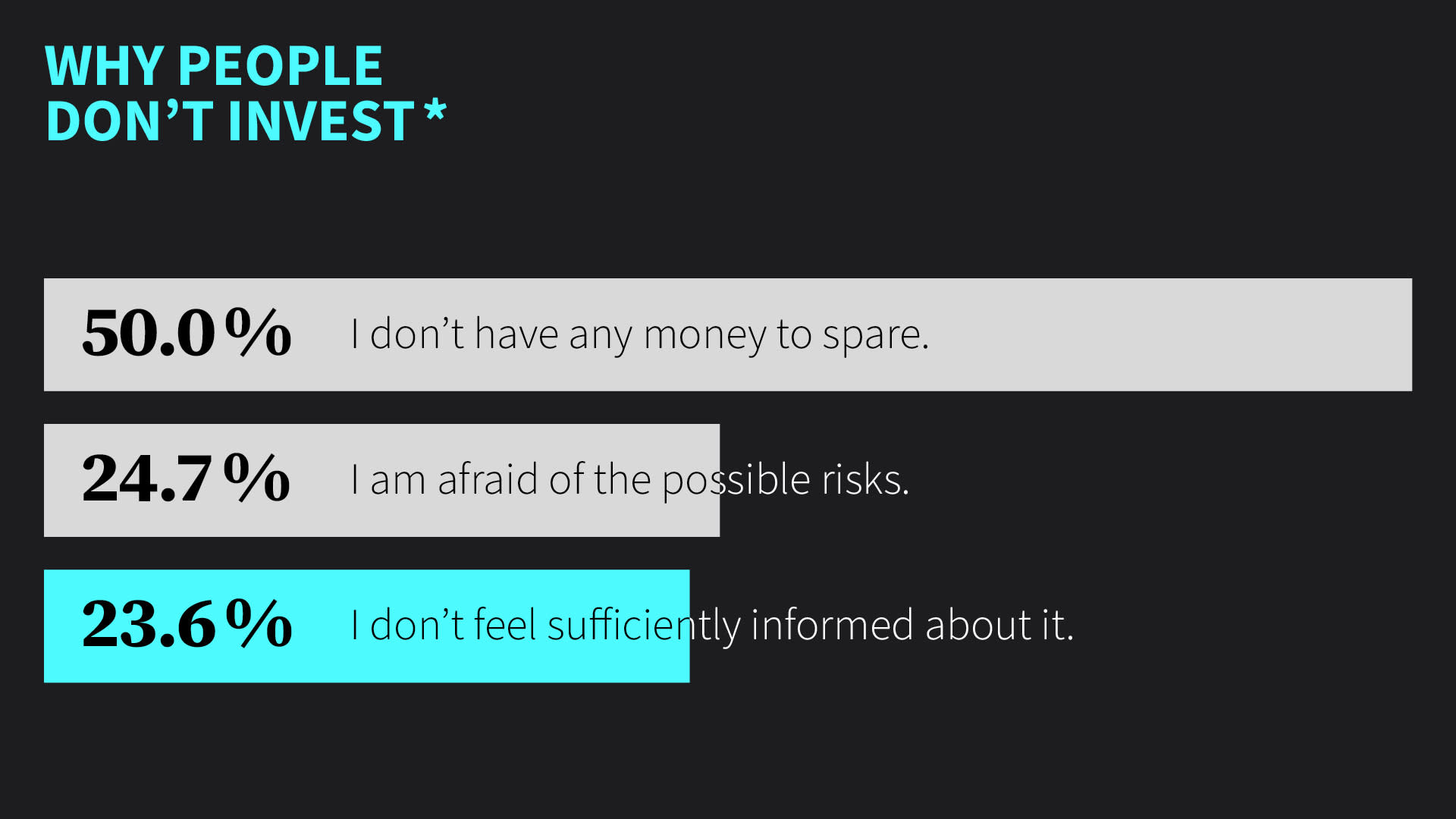

47.3 per cent of people in Germany do not currently invest any money

The reasons why almost half of the people in Germany do not invest money or invest in financial products are varied. The most frequently cited reason is that there is no money left over for it, the fear of the risks is too great or people do not feel well enough informed.

*Excerpts of answers to the question: "Why don’t you currently invest or place your money in financial products?" (Only respondents who do not currently invest money in financial products).

Source: IU short study "Financial literacy. What is the level of financial literacy in Germany?"

Family, guidebooks and financial websites are often mentioned sources for financial literacy

For more than four out of ten respondents, family is a source of financial advice. General guides and financial websites are also frequently mentioned. It is noticeable among Generation Z: Respondents under the age of 25 are particularly likely to name family and social media as sources of information.

*Excerpts of answers to the question: "What sources do you use to (further) educate yourself financially?"

Source: IU short study "Financial literacy. What is the level of financial literacy in Germany?"

More education, more investment in education

„Finances are always about trust. But if you trust yourself, your family or influencers too much, you are taking an unnecessary risk. With below-average financial literacy in this country, we urgently need more easy-to-understand information and educational investment in this area."

Prof. Dr Johannes Treu

Professor of General Business Administration and Economics at IU International University of Applied Sciences

The entire IU short study on financial literacy - including expert interview

This is the level of financial literacy in Germany. All the facts and the expert interview with Prof. Dr Johannes Treu in the IU short study.

View the study as PDFMore info on the IU study

REQUEST FREE INFORMATION

You'll find all of the important information about your study programme and IU International University of Applied Sciences in your personal brochure.